Income tax declaration for 2023: All the Dates and potential savings!

In France, taxes are deducted at source, so every month you pay your income taxes. BUT you still have to make a declaration.

As of April 11, you will be able to file your income declaration for the year 2023.

The deadline, if paper version, is set for May 21, 2024 and

Great news! If you declare online, you will benefit from additional deadlines according to your address of domicile on January 1, 2024.

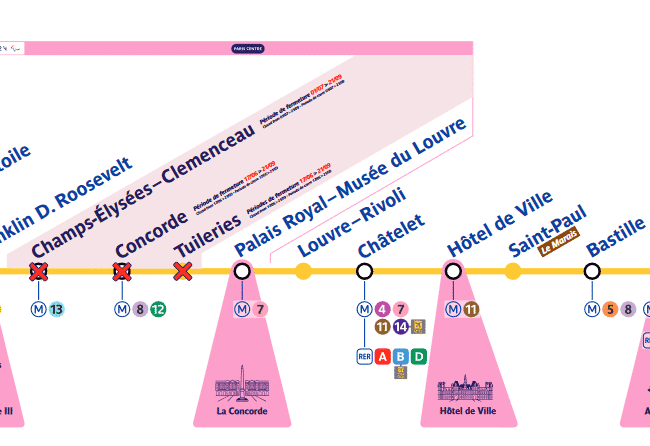

May 23, 2024, at 11:59 PM: departments 01 to 19 and non-residents;

May 30, 2024, at 11:59 PM: departments 20 to 54;

June 6, 2024, at 11:59 PM: departments 55 to 976. (Paris and area)

Who needs to make a declaration?

- you reside and have a main professional activity in France;

- you turned 18 last year and are not attached to your parents’ tax household;

- you reside abroad but your income is from French sources.

How to declare your income?

- Online Declaration If you already have your French fiscal number;

- If you do not have a fiscal number, you must request it.

At the end of your 2023 income declaration:

- you will be able to know the withholding tax rate that will apply to your income starting from August 2024;

- from the end of July, you will receive your 2024 tax notice based on your 2023 income declaration. you can make a correction;

- If you do not have an online access number or a reference fiscal income, you cannot declare online this year. You must submit a paper income declaration.

Tax reduction!

- when you make donations, many are tax deductible in part

- you have home services, for your children, the cleaning… you may be entitled to reduction

Special regime for impatriates!

There is a special tax regime for impatriates which could permit you to benefit from some tax exemptions.

Filling in your tax declaration for the first time in France or you need help? contact@enyter.com 01 30 84 08 18